Direct primary care has gained popularity as an alternative to traditional healthcare models, but potential patients often question whether this approach has significant downsides.

The disadvantages of direct primary care deserve honest examination before making such an important healthcare decision. We at NuMed DPC believe transparency about both benefits and limitations helps patients make informed choices about their medical care.

What Are People Most Worried About With DPC?

Three primary concerns dominate conversations when patients consider direct primary care: the additional monthly expense on top of existing insurance premiums, restricted access to specialists, and the perception that DPC caters only to wealthy patients. Monthly membership fees typically range from $50 to $100 per month according to Balanced Healthcare data, which patients often view as an extra burden rather than a replacement cost. Many assume they pay twice for healthcare when traditional insurance already covers primary care visits, though this overlooks the significant co-pays and deductibles that traditional plans require.

Limited Specialist Networks Create Real Access Issues

DPC practices maintain smaller referral networks compared to large insurance systems, which can delay specialist appointments and limit patient choice. Most DPC physicians serve 300-600 patients versus the 2,000-3,000 in traditional practices, but this smaller scale means fewer established specialist relationships. Patients who need immediate access to specific specialists may face longer wait times or need to travel further distances. Geographic limitations compound this problem, as approximately 2,000-3,000 DPC practices serve the entire United States (leaving many regions without nearby options).

The Elite Healthcare Perception Problem

The monthly membership model creates an unfortunate perception that DPC serves only affluent patients who can afford premium healthcare services. This reputation stems partly from concierge medicine, which charges thousands annually, though DPC fees remain significantly lower. The reality shows that physician shortages affect 31 out of 35 physician specialties, including primary care, which makes DPC an accessibility solution rather than an exclusive service. However, low-income patients genuinely struggle with the dual burden of insurance premiums plus membership fees (a legitimate barrier that sliding-scale programs attempt to address).

These concerns reflect real patient experiences, but they often stem from incomplete information about how DPC actually functions within the broader healthcare system.

What Do DPC Costs Really Look Like?

The math behind direct primary care reveals dramatic savings that most patients never calculate properly. Traditional insurance holders face significant monthly costs, with family premiums for employer-sponsored health insurance reaching an average of $26,993 annually, plus co-pays per visit. DPC membership fees of $50-100 monthly eliminate co-pays entirely while providing unlimited visits (making the break-even point just two traditional visits per year). Patients with high-deductible plans face even steeper savings since they pay full price for primary care until reaching deductibles of $1,400 for individuals.

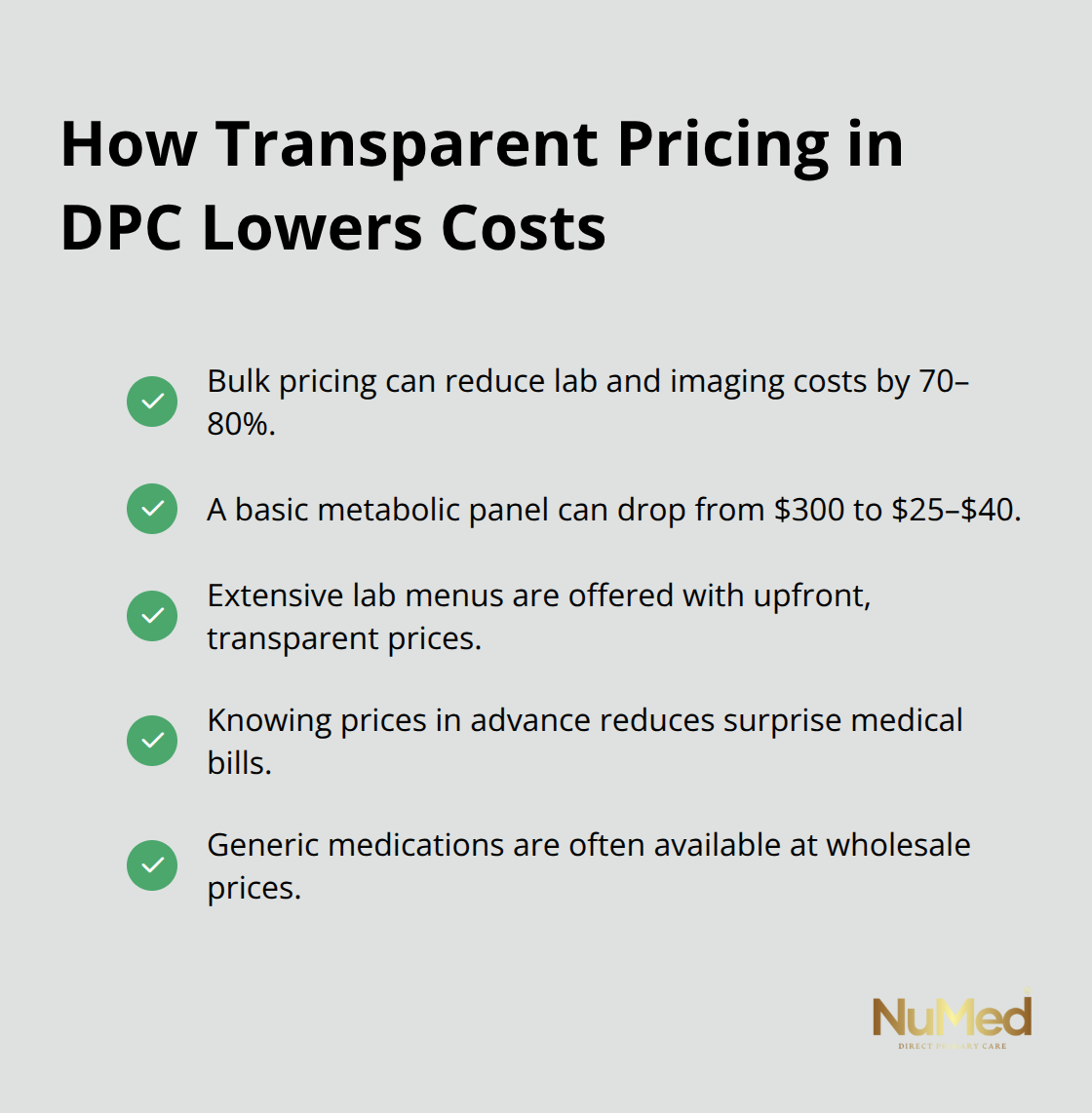

Transparent Pricing Eliminates Financial Surprises

DPC practices negotiate bulk pricing for lab tests and imaging, often reducing costs by 70-80% compared to hospital-based pricing. A basic metabolic panel that costs $300 through traditional channels drops to $25-40 in DPC settings. Most DPC providers offer extensive lab services with transparent pricing that patients know upfront, removing the anxiety of surprise medical bills that plague traditional healthcare.

Prescription medications cost significantly less through DPC pharmacy partnerships, with generic drugs available at wholesale prices rather than insurance markup rates.

Preventive Care Investment Pays Long-Term Dividends

Primary care physicians face overwhelming time constraints, with studies showing they would need 26.7 hours per day to deliver all recommended care. DPC patients receive extended appointments that allow comprehensive preventive care, catching problems early. This extended time investment reduces emergency room visits through early identification of health issues before they become expensive crises. Chronic disease management through regular DPC monitoring prevents costly hospitalizations and specialist interventions that can cost thousands per episode (creating substantial long-term savings).

Hidden Insurance Costs Add Up Quickly

Traditional insurance models hide numerous fees that patients rarely calculate in their total healthcare expenses. Administrative costs, network restrictions, and prior authorization delays create indirect expenses that DPC eliminates entirely. The predictable monthly expense structure helps patients budget healthcare costs accurately while receiving proactive care that traditional insurance models actively discourage through co-pay barriers.

These financial realities become even more important when considering the practical limitations that DPC faces in emergency situations and hospital coverage.

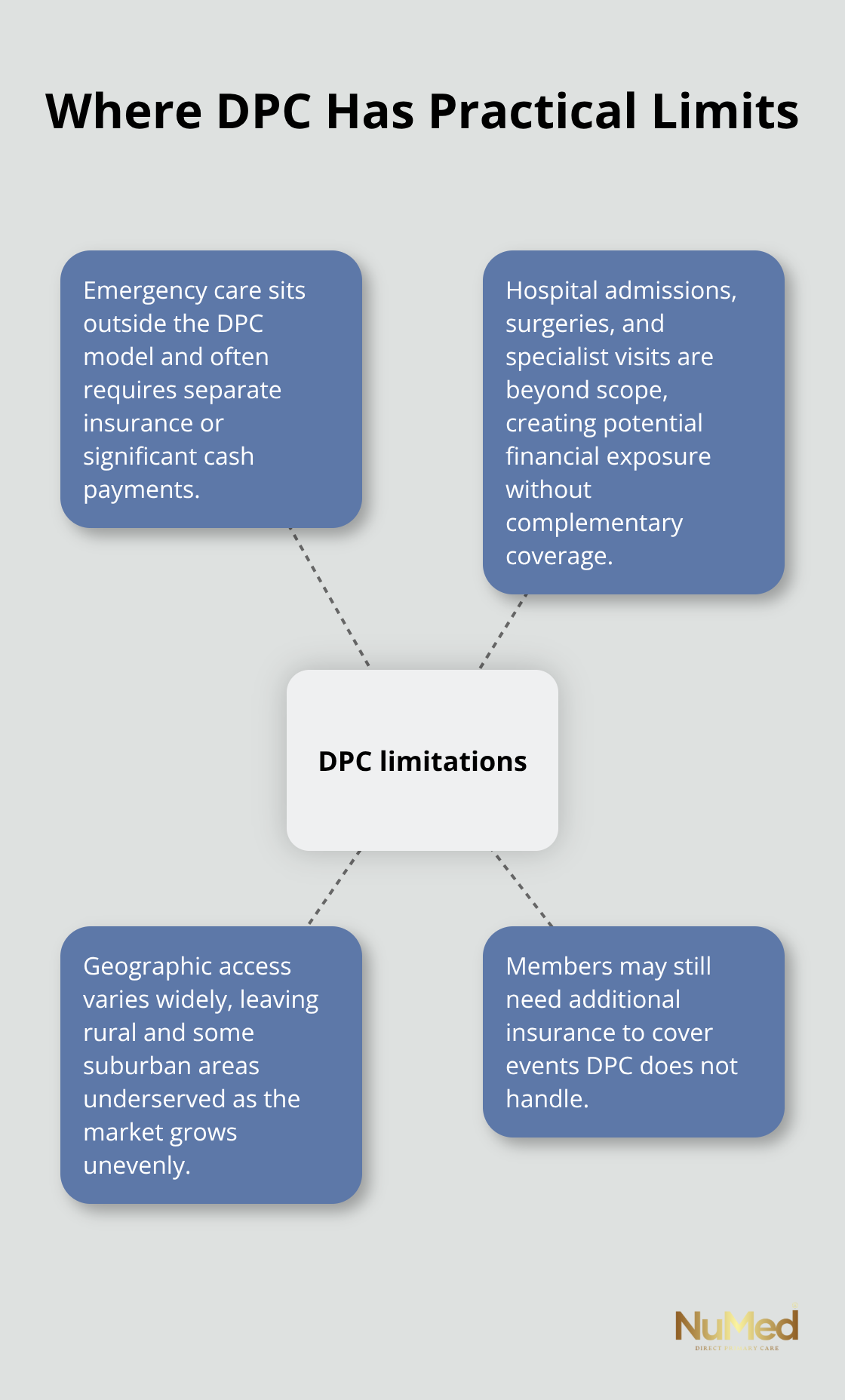

Where Does DPC Fall Short in Practice?

DPC practices face three significant operational limitations that patients must understand before enrollment. Emergency care remains completely outside the DPC model and requires separate insurance coverage or cash payments that can reach thousands of dollars per incident. Hospital admissions, surgical procedures, and specialist consultations fall beyond DPC scope and create substantial financial exposure for members without complementary insurance. Geographic accessibility presents another major barrier, with the DPC market valued at USD 59.5 billion in 2024 and predicted to reach USD 92.9 billion by 2034, which leaves rural and suburban areas severely underserved.

Provider Network Integration Creates Real Barriers

Most DPC physicians operate independently from major health systems and limit their ability to coordinate care seamlessly with specialists and hospitals. Electronic medical record systems rarely integrate between DPC practices and traditional healthcare networks, which forces patients to manage their own medical information transfer. Laboratory results, imaging studies, and specialist reports require manual coordination that can delay treatment decisions. Medicare and Medicaid patients face particular challenges since these programs cannot legally pay for DPC services, though HSA payments are now allowed for monthly membership fees under $150. The administrative burden shifts to patients who must navigate multiple payment systems and coordinate their own referrals.

Capacity Limitations Affect Access

DPC practices deliberately limit patient panels to 300-600 members to maintain quality care, but this creates access bottlenecks in high-demand areas. New patient wait lists extend several months in popular DPC markets, particularly in metropolitan areas where primary care shortages already exist. Practice capacity constraints mean that patients cannot always access same-day appointments during peak illness seasons (despite DPC promises of enhanced availability).

Single-physician DPC practices face continuity problems during vacations, illness, or emergencies and leave patients without their primary provider for extended periods.

Technology and Communication Gaps

DPC practices often lack the sophisticated technology infrastructure that large health systems provide. Many DPC physicians rely on basic electronic health records that don’t communicate with hospital systems or specialist offices. Patients frequently receive paper copies of test results instead of digital access through patient portals. Telemedicine capabilities vary widely among DPC practices, with some providers offering comprehensive virtual care while others maintain traditional in-person models only.

Final Thoughts

The disadvantages of direct primary care present real challenges that patients must weigh against substantial benefits. Monthly membership fees create additional expenses, specialist access remains limited, and emergency coverage requires separate insurance. Geographic availability affects rural patients most severely, while technology gaps can complicate care coordination.

However, the financial mathematics strongly favor DPC for most patients. Traditional insurance holders pay thousands annually in premiums plus co-pays, while DPC eliminates visit fees entirely. Transparent lab prices and wholesale medication costs create immediate savings that compound over time through preventive care investments. The extended appointment times and personalized attention that DPC provides address the root causes of health problems before they become expensive emergencies.

We at NuMed DPC recognize these trade-offs and work to minimize limitations through comprehensive lab services and transparent prices. Our model focuses on prevention by addressing underlying causes rather than simply treating symptoms. For patients who seek personalized healthcare without insurance complications, NuMed DPC offers compassionate and holistic care that empowers individuals to achieve optimal health outcomes (despite the initial concerns about DPC that fade when patients experience genuine benefits).