Most patients asking “Does insurance cover functional medicine” face disappointing answers from their providers. Traditional health plans rarely reimburse functional medicine visits, leaving patients to navigate complex payment alternatives.

We at NuMed DPC see this coverage gap daily, as patients struggle with out-of-pocket costs for comprehensive care. The insurance landscape for functional medicine remains challenging but not impossible to navigate.

How Does Current Insurance Cover Functional Medicine

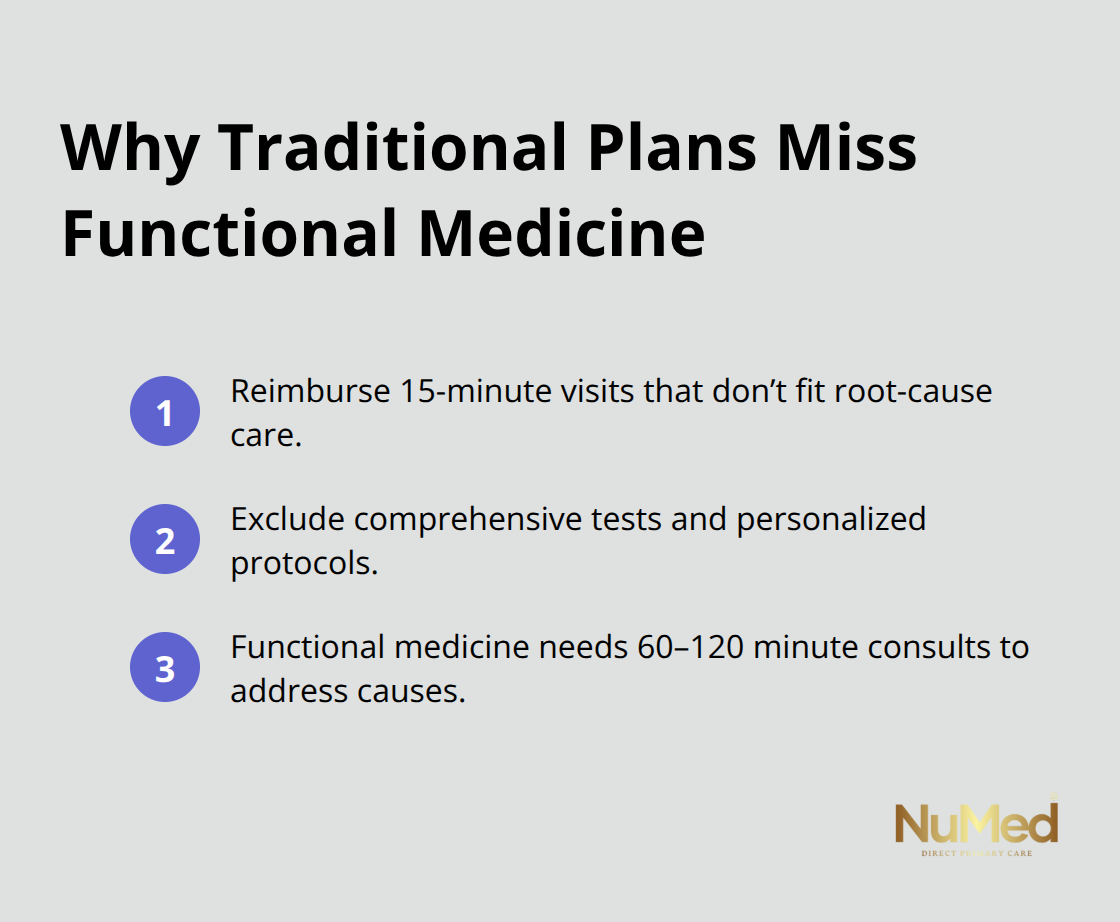

Traditional Health Plans Fall Short

Most traditional health insurance plans operate on a disease-treatment model that conflicts directly with functional medicine’s preventive approach. The Agency for Healthcare Research and Quality uses quality indicators to track healthcare utilization, but standard insurance covers symptom-based treatments while excluding the comprehensive tests and personalized protocols that define functional medicine. Private insurers typically reimburse 15-minute appointment slots, while functional medicine requires 60-120 minute initial consultations to address root causes effectively.

Major insurance providers like Blue Cross Blue Shield and Aetna rarely cover specialized functional medicine lab work, which includes comprehensive metabolic panels, food sensitivity tests, or advanced hormone assessments. These tests often cost patients $300-800 out-of-pocket per visit and create significant financial barriers for those who seek integrative care.

Medicare Creates Strict Limitations

Medicare coverage for functional medicine remains extremely limited and focuses only on conventional treatments with established codes. The Centers for Medicare and Medicaid Services has expanded telehealth coverage across urban and rural settings, but this expansion doesn’t extend to functional medicine consultations or specialized tests. Medicare patients face the harshest restrictions, as the program excludes nutritional therapy, advanced diagnostics, and lifestyle coaching (the foundation of functional medicine).

Medicaid Programs Follow Similar Patterns

Medicaid programs vary by state but generally follow Medicare’s restrictive approach. State Medicaid programs cover basic metabolic panels and vitamin D assessments only when traditional medical necessity criteria are met. This leaves functional medicine practitioners with limited reimbursement options for their comprehensive care models.

Private Insurance Variations Create Confusion

Private insurance coverage for functional medicine varies dramatically between providers and individual plans. Some insurers negotiate discounts with selected functional medicine providers, but these arrangements don’t constitute formal insurance coverage. Only about one-third of examined health plans cover acupuncture (one of the more accepted complementary therapies), and most coverage remains minimal.

These coverage gaps explain why insurance companies resist broader functional medicine benefits and why alternative payment models continue to gain popularity.

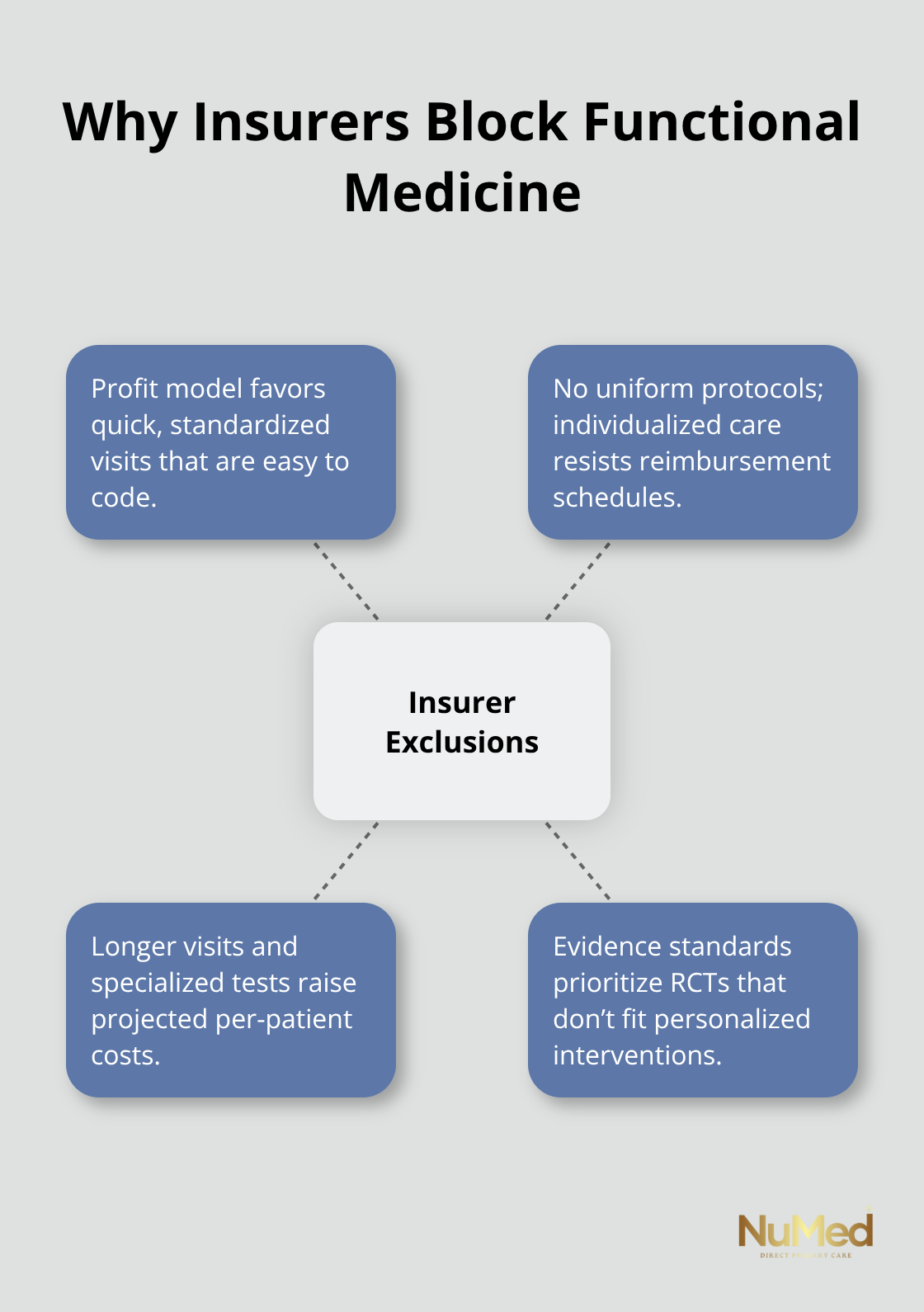

Why Do Insurers Block Functional Medicine

Insurance companies systematically exclude functional medicine because it threatens their profit-driven business model built on quick fixes and standardized treatments. The $30 billion complementary and alternative medicine market in the U.S. operates outside traditional insurance frameworks, which forces companies to protect their margins by rejecting comprehensive care approaches. Insurers design their systems around 15-minute appointments with predictable codes, while functional medicine requires 60-120 minute consultations that don’t fit their cost-control algorithms.

Standardized Protocols Don’t Exist

Insurance companies demand uniform treatment protocols that functional medicine cannot provide due to its personalized approach. Traditional medicine offers clear pathways: chest pain equals cardiac workup, diabetes equals metformin prescription. Functional medicine practitioners customize treatments based on individual genetic profiles, environmental factors, and comprehensive lab panels that vary dramatically between patients. This individualization makes it impossible for insurers to predict costs or create standardized reimbursement schedules, which forces them to exclude these services entirely.

Budget Constraints Drive Exclusions

Insurers calculate that functional medicine’s longer appointments would significantly increase their costs per patient compared to conventional care. Functional medicine visits often last 45-90 minutes compared to typical 7-minute conventional visits, and insurance doesn’t cover these extended consultations. A typical functional medicine workup includes specialized tests that cost $300-800 (tests that traditional medicine rarely orders). Insurance actuaries project that coverage for functional medicine would require premium increases that would make their plans uncompetitive in the marketplace, so they maintain exclusions to preserve their advantage.

Clinical Evidence Standards Block Coverage

Insurance medical directors require randomized controlled trials that functional medicine cannot easily provide due to its personalized nature. While the Agency for Healthcare Research shows acupuncture could improve short-term chronic pain intensity with a very small effect according to their 2020 Comparative Effectiveness Review, most functional medicine interventions combine multiple approaches that resist traditional study designs. Insurers use these evidence gaps to justify coverage denials, even though patients who utilize complementary therapies often report lower overall healthcare costs despite higher out-of-pocket expenses.

These systematic barriers explain why patients increasingly turn to alternative payment models that bypass traditional insurance limitations entirely.

What Payment Options Work for Functional Medicine

Direct Primary Care Membership Models

Direct primary care membership plans offer the most effective payment solution for functional medicine services because they eliminate insurance middlemen entirely. DPC practices typically charge $55-150 monthly for unlimited visits, which creates predictable costs for patients who need frequent functional medicine consultations. This model allows practitioners to spend 45-90 minutes per appointment without insurance time restrictions, which makes functional medicine economically viable for both providers and patients.

Monthly membership fees cover extensive lab services, health coaching, and personalized treatments that traditional insurance excludes. Patients avoid copays, deductibles, and prior authorization delays that plague conventional insurance models. DPC providers focus on prevention by addressing root causes rather than symptom management, which aligns perfectly with functional medicine principles.

Health Savings Account Advantages

Health Savings Accounts provide significant tax advantages for functional medicine expenses when paired with high-deductible health plans. HSA contributions reduce taxable income dollar-for-dollar, and withdrawals for qualified medical expenses remain tax-free permanently. Patients can use HSA funds for functional medicine consultations, specialized lab work, and supplements prescribed by licensed practitioners.

HSA contribution limits depend on your coverage type and age, which covers substantial functional medicine costs while patients build long-term health investment accounts. Flexible Spending Accounts offer similar benefits but require annual expenditure within plan years, which makes them less suitable for ongoing functional medicine care.

Strategic Out-of-Pocket Payment Plans

Smart patients budget 3-5% of their annual income for functional medicine expenses and negotiate payment plans with providers who offer sliding scale fees or package deals. Many functional medicine practices provide superbills that patients submit independently for partial reimbursement, which reduces administrative costs while maintaining some insurance benefits.

Patients should request itemized treatment plans upfront to compare provider costs, as functional medicine consultations range from $200-500 initially and $150-300 for follow-ups across different markets. Some practices offer payment packages that bundle initial consultations with follow-up visits at discounted rates (typically 10-20% savings compared to individual appointments).

Final Thoughts

The question “Does insurance cover functional medicine?” exposes a healthcare system that values quick fixes over comprehensive care. Traditional insurers systematically exclude functional medicine because personalized treatments don’t fit their standardized profit models. Patients face limited coverage options for root-cause medicine that addresses underlying health issues.

Alternative payment models gain rapid traction as patients seek affordable access to functional medicine. Direct primary care membership plans eliminate insurance barriers while they provide unlimited consultations and extensive lab services at predictable monthly costs. Health Savings Accounts offer tax advantages that make functional medicine more accessible (while strategic out-of-pocket payment plans help patients budget for comprehensive care).

The future looks promising for functional medicine accessibility as more patients abandon traditional insurance limitations. Patients choose transparent pricing and personalized care over insurance hassles, which creates a sustainable path toward better health outcomes. We at NuMed DPC witness this shift daily as patients embrace membership-based models that prioritize patient outcomes over insurance restrictions.