Direct primary care membership fees can potentially reduce your tax burden, but the rules aren’t straightforward. Many patients wonder: is direct primary care tax deductible under current IRS guidelines?

We at NuMed DPC see this question frequently from members exploring their tax options. The answer depends on your specific situation, how you pay for care, and which deduction strategies you use.

How Does the IRS Treat DPC Payments

The IRS classifies Direct Primary Care membership fees as qualified medical expenses under Section 213(d) of the Internal Revenue Code. This classification makes DPC payments potentially tax-deductible for many patients. Medical expenses must exceed 7.5% of your adjusted gross income to qualify for itemized deductions under current IRS rules.

For 2024, this threshold creates a significant hurdle. A taxpayer who earns $60,000 annually needs medical expenses above $4,500 to claim any deductions. This requirement affects how most people approach DPC tax benefits.

DPC Membership Fees vs Traditional Insurance Premiums

DPC operates with fundamentally different tax treatment compared to insurance premiums. Insurance premiums for self-employed individuals qualify as above-the-line deductions, which reduce adjusted gross income directly. DPC membership fees fall under medical expense deductions, which require itemization and meeting the 7.5% AGI threshold.

The IRS previously classified DPC as secondary insurance due to monthly subscription models. Recent legislative changes clarify DPC’s distinct status from traditional insurance coverage. This distinction matters significantly for tax purposes.

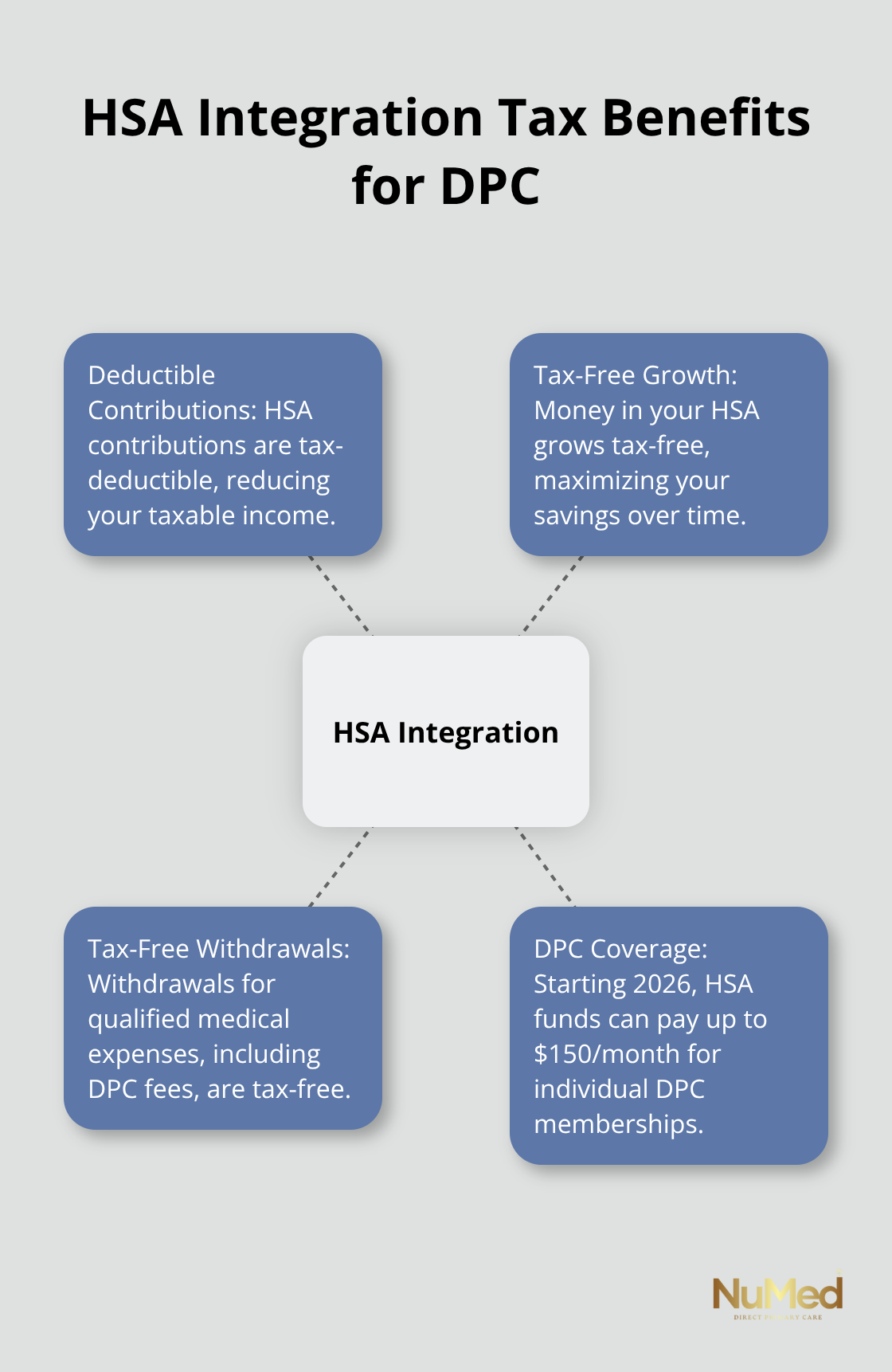

Health Savings Account Integration Changes Everything

The One Big Beautiful Bill Act enables HSA-eligible individuals to participate in Direct Primary Care arrangements, with HSA funds available tax-free for periodic DPC fees. This represents a major shift since over 61 million Americans currently hold HSA-eligible accounts.

HSA contributions for 2024 reach $4,150 for individual coverage and $8,300 for family coverage (with an additional $1,000 catch-up contribution for those 55 and older). HSA distributions for qualified medical expenses remain tax-free, which makes this the most advantageous tax strategy for DPC payments.

Documentation Requirements for Tax Claims

The IRS requires specific documentation to support DPC deductions. Taxpayers must maintain receipts for all DPC services and payments throughout the tax year. These records must clearly show the medical nature of services received and the amounts paid.

DPC arrangements that charge flat monthly fees for a range of services face particular scrutiny. The IRS examines whether these payments qualify as medical expenses under tax law definitions. Proper documentation becomes essential for successful deduction claims.

Now that you understand how the IRS treats DPC payments, let’s explore specific strategies to maximize your tax benefits through different deduction methods.

How Can You Maximize DPC Tax Benefits

HSA Integration Creates the Strongest Tax Advantage

Health Savings Accounts provide the most powerful tax strategy for Direct Primary Care payments. Starting January 2026, HSA funds can pay for DPC memberships up to $150 monthly for individuals or $300 for families under the One Big Beautiful Bill Act. This creates triple tax benefits: deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

The math works strongly in your favor. A single person who contributes the 2024 maximum of $4,150 to an HSA saves $1,037 in federal taxes at a 25% tax bracket. DPC membership costs $1,800 annually at $150 monthly, which leaves $2,350 in HSA funds for other medical expenses. Workers aged 55 and older gain an additional $1,000 catch-up contribution, which increases total tax savings to $1,287 annually.

Schedule A Itemization Requires Strategic Planning

Medical expense deductions through Schedule A itemization demand careful calculation. The 7.5% adjusted gross income threshold creates a high bar for most taxpayers. Someone who earns $80,000 needs medical expenses that exceed $6,000 before they claim any deductions. DPC membership alone rarely reaches this threshold.

Successful itemization requires you to bundle DPC costs with other medical expenses. Dental work, vision care, prescription medications, and medical travel expenses count toward the threshold. You maximize deduction potential when you time elective procedures within the same tax year. Self-employed individuals face different rules and often benefit from above-the-line health insurance deductions instead.

Business Owners Gain Additional Deduction Opportunities

Self-employed individuals can deduct DPC membership fees as business expenses when the arrangement covers the business owner. This above-the-line deduction reduces adjusted gross income directly without itemization requirements. The deduction applies to sole proprietors, partners, and S-corporation shareholders who own more than 2% of company stock.

C-corporation owners face restrictions on personal medical expense deductions but can establish employer-sponsored DPC arrangements. Small businesses can benefit from level-funded plans that incorporate DPC services. Employers can pay DPC membership fees directly without tax consequences for employees when they structure arrangements properly within high-deductible health plan frameworks.

Documentation Standards Protect Your Deductions

The IRS requires specific documentation to support all DPC tax claims. You must maintain receipts for DPC services and payments throughout the tax year. These records must clearly show the medical nature of services received and the amounts paid (monthly membership fees, additional service charges, and any supplemental costs).

Tax professionals recommend separate bank accounts or credit cards for medical expenses to simplify record maintenance. Digital receipt storage through apps or cloud services helps organize documentation efficiently. You should also keep copies of DPC membership agreements that detail covered services and fee structures.

Proper documentation becomes even more important as you explore advanced tax strategies that combine multiple deduction methods.

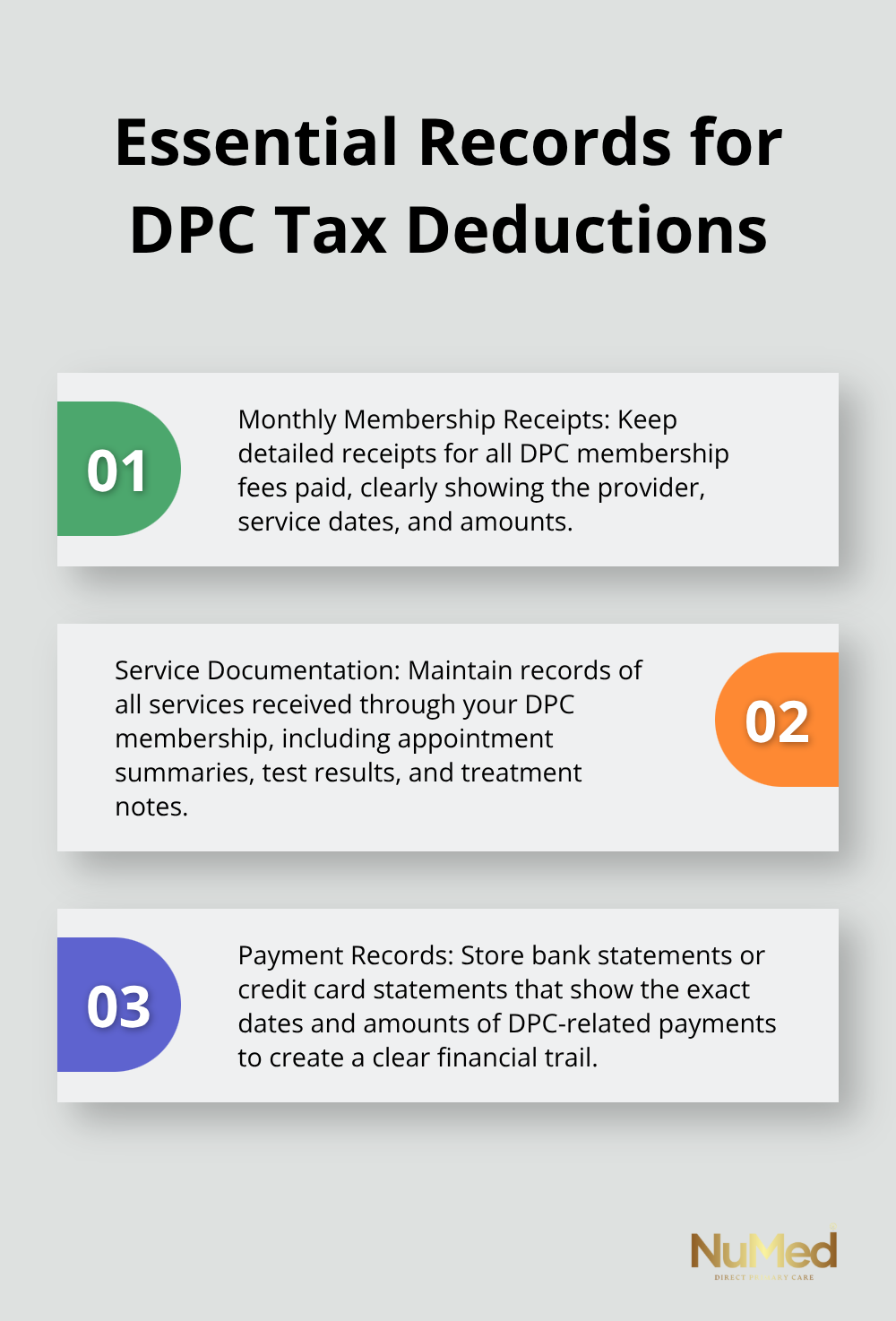

What Records Do You Need for DPC Tax Deductions

The IRS demands specific documentation to support Direct Primary Care tax deductions, and missing records can cost you thousands in lost benefits. Tax auditors scrutinize medical expense claims more heavily than other deductions. You need comprehensive documentation that proves both the medical nature of your DPC services and the exact amounts paid throughout the tax year.

Document Every DPC Payment With Precision

Your DPC documentation must include monthly membership receipts, additional service invoices, and bank statements that show payment dates. The IRS requires receipts that clearly identify the provider, service dates, amounts paid, and medical nature of services received. Generic credit card statements alone won’t satisfy audit requirements.

Create a dedicated folder system with digital copies of all DPC-related documents, organized by month and payment type. Tax professionals suggest you use separate bank accounts or credit cards exclusively for medical expenses to create clear paper trails. Keep copies of your DPC membership agreement that details covered services and fee structures, as this document establishes the medical nature of your payments.

Maintain Service Records and Medical Documentation

The IRS examines whether DPC services qualify as legitimate medical expenses under tax law definitions. You must document each service you receive through your DPC membership, including routine check-ups, chronic disease management, and preventive care visits. Store appointment summaries, test results, and treatment notes that demonstrate the medical necessity of your DPC membership.

Digital receipt storage through apps or cloud services helps you organize documentation efficiently. Many DPC practices provide detailed monthly statements that break down services received versus membership fees paid (which simplifies your record maintenance significantly).

Professional Tax Guidance Maximizes Your Benefits

Tax professionals who specialize in medical deductions can identify opportunities you might miss and help structure payments to optimize tax benefits. They understand which DPC services qualify as deductible medical expenses versus general wellness programs that don’t meet IRS requirements.

A qualified tax advisor can also help you time medical procedures and DPC payments to exceed the 7.5% adjusted gross income threshold in specific tax years. Professional preparation becomes especially valuable when you combine DPC deductions with HSA contributions or business expense claims. If you have questions about specific documentation requirements, consulting with tax professionals ensures you maintain compliant records.

Final Thoughts

Direct Primary Care offers multiple tax deduction pathways that can significantly reduce your healthcare costs. HSA integration provides the strongest tax advantage through deductible contributions, tax-free growth, and tax-free withdrawals for DPC membership fees up to $150 monthly starting January 2026. Schedule A itemization works when you bundle DPC costs with other medical expenses to exceed the 7.5% adjusted gross income threshold, while self-employed individuals gain additional opportunities through business expense deductions that reduce adjusted gross income directly.

The question “Is Direct Primary Care tax-deductible?” depends entirely on your specific financial situation and chosen deduction strategy. Success requires meticulous documentation of all payments, services received, and medical necessity (professional tax guidance becomes essential for maximizing benefits while maintaining IRS compliance). Each taxpayer must evaluate their unique circumstances to determine which approach delivers the greatest tax savings.

We at NuMed DPC understand that tax implications shouldn’t complicate your healthcare decisions. Our comprehensive direct primary care model combines transparent pricing with potential tax benefits to make quality healthcare more accessible than traditional insurance-based models. The combination of personalized care and tax advantages creates a compelling alternative for patients who want both financial efficiency and exceptional medical attention.