Hormone therapy can be a life-changing treatment for many individuals, but the question often arises: Does insurance cover hormone therapy? At NuMed DPC, we understand the importance of this question for our patients.

In this post, we’ll explore the ins and outs of insurance coverage for hormone therapy, helping you navigate the often complex world of healthcare policies and treatments.

What Is Hormone Therapy?

Definition and Purpose

Hormone therapy is a medical treatment that supplements, blocks, or replaces hormones in the body to address various health conditions. This therapy aims to restore hormonal balance, alleviate symptoms, and improve overall well-being.

Common Conditions Treated

Hormone therapy treats a wide range of conditions. Women often use it to manage menopausal symptoms such as hot flashes, night sweats, and vaginal dryness. A study by the North American Menopause Society indicates no universal guideline for stopping hormone therapy in older women, highlighting its ongoing importance for many patients.

Men use hormone therapy to address issues like low testosterone levels, which can affect energy, libido, and muscle mass. It also plays a role in treating certain types of cancer (prostate cancer in men and breast cancer in women).

Other applications include:

- Thyroid disorders

- Growth hormone deficiencies

- Gender-affirming care for transgender individuals

A 2024 study shows that the health effects of hormone replacement therapy (HRT) for women 65 and older depend on the type, method, and dosage used, emphasizing the need for personalized treatment plans.

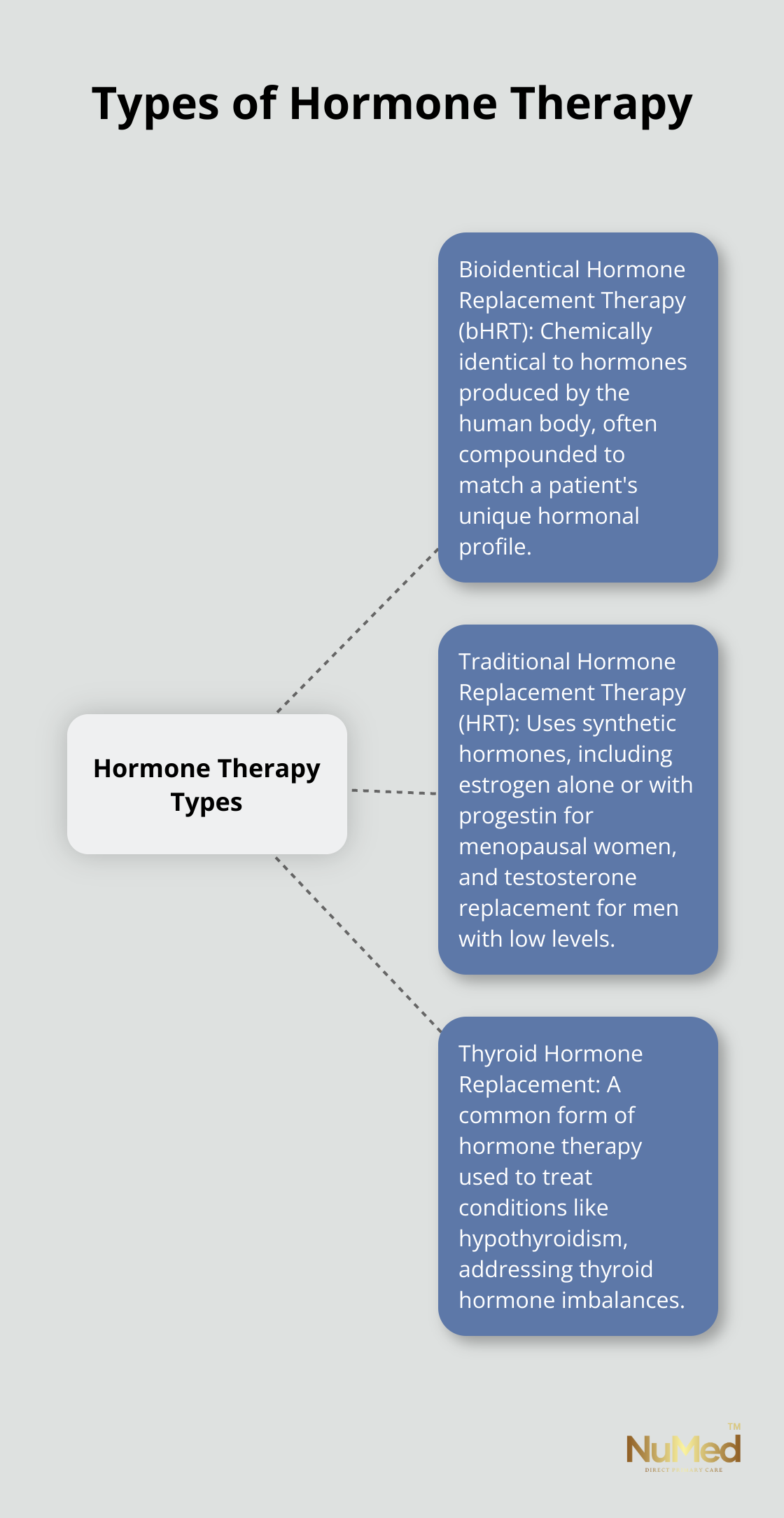

Types of Hormone Therapy Available

Several types of hormone therapy exist, each tailored to specific needs and conditions:

- Bioidentical Hormone Replacement Therapy (bHRT): Many individuals experiencing hormonal imbalances seek bHRT. These hormones are chemically identical to those produced by the human body and are often compounded to match a patient’s unique hormonal profile.

- Traditional Hormone Replacement Therapy (HRT): This typically uses synthetic hormones. For menopausal women, it might include estrogen alone or in combination with progestin. Men with low testosterone might receive testosterone replacement therapy through injections, gels, or patches.

- Thyroid Hormone Replacement: This common form of hormone therapy treats conditions like hypothyroidism.

The cost for these treatments can vary widely. For instance, a box of generic estradiol can range from $31 to $57, while 30 tablets of Premarin (conjugated estrogens) may cost between $228 and $246.

Choosing the right hormone therapy is a personal decision that requires consultation with a healthcare provider. A comprehensive evaluation and personalized treatment plan ensure the most effective and safe hormone therapy for each individual patient.

As we move forward, it’s important to understand how insurance coverage plays a role in accessing these vital treatments. Let’s explore the factors that affect insurance coverage for hormone therapy and what you need to know to navigate this aspect of your healthcare journey.

Will Your Insurance Cover Hormone Therapy?

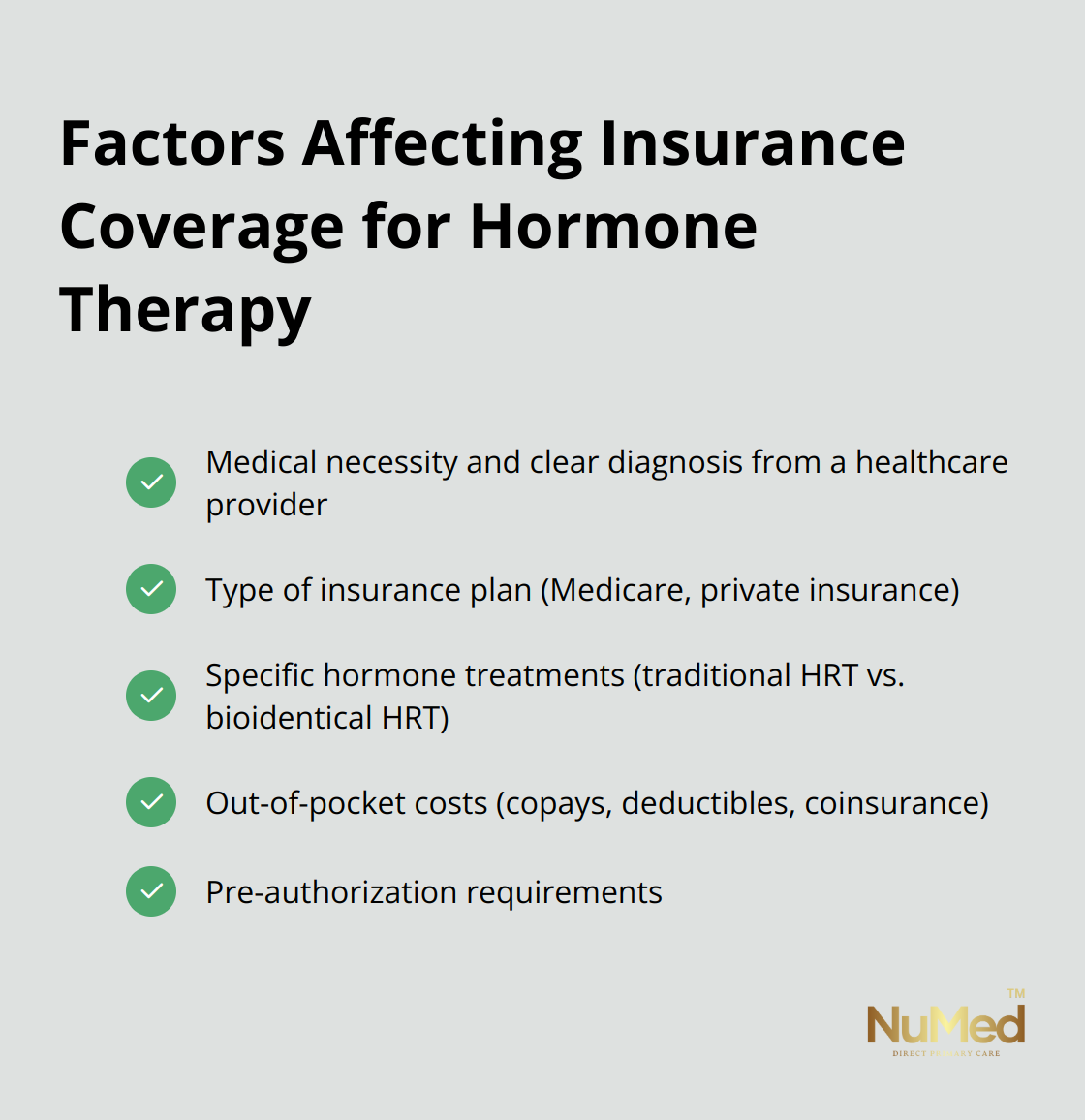

Medical Necessity and Diagnosis

Insurance companies often require hormone therapy to be medically necessary for coverage. You need a clear diagnosis from a healthcare provider to justify hormone treatment. A diagnosis of severe menopausal symptoms or clinically low testosterone levels can support the medical necessity of hormone therapy.

Type of Insurance Plan

Your insurance plan type significantly impacts hormone therapy coverage. Medicare may cover hormone replacement therapy (HRT) when it’s medically necessary. Coverage varies depending on the specific Medicare part or plan. Medicare Part B might cover doctor visits and treatments related to hormone therapy, while prescription hormones typically fall under Medicare Part D coverage.

Private insurance plans differ in their coverage. Some plans have specific exclusions or limitations on hormone therapy, while others offer more comprehensive coverage. Review your policy details or contact your insurance provider directly to understand your specific coverage.

Specific Hormone Treatments

Insurance companies don’t treat all types of hormone therapy equally. Traditional hormone replacement therapy (HRT) has a higher likelihood of coverage than bioidentical hormone replacement therapy (bHRT). This occurs because bHRT often involves compounded medications, which lack FDA approval and may be excluded from coverage by many insurance plans.

For example, insurance might cover a box of generic estradiol, while bioidentical alternatives might lack coverage entirely. Similarly, testosterone therapy for women may not always receive inclusion in insurance plans, even if it’s covered for men.

Out-of-Pocket Costs

Even with insurance coverage, you may face out-of-pocket expenses for hormone therapy. These can include copays, deductibles, and coinsurance.

Navigating Coverage Complexities

Understanding your insurance coverage for hormone therapy plays a vital role in managing your healthcare costs effectively. Don’t hesitate to ask questions, seek clarification from your insurance provider, and explore all your options to ensure you receive the treatment you need at a manageable cost.

As you consider your options for hormone therapy and insurance coverage, it’s important to know how to determine your specific coverage. The next section will guide you through the steps to understand your insurance policy and explore alternative payment options if needed.

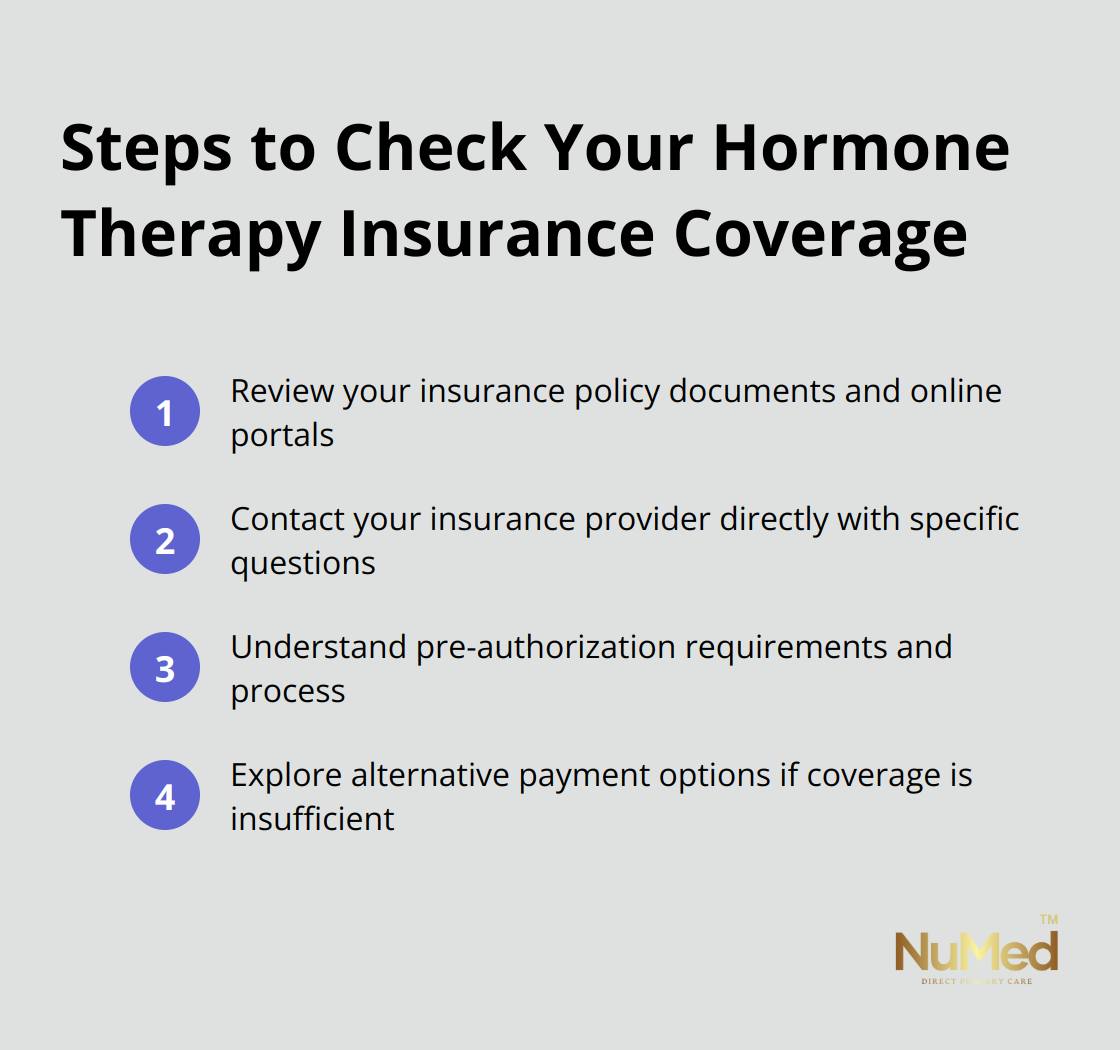

How to Check Your Hormone Therapy Insurance Coverage

Review Your Insurance Policy

Start with a thorough examination of your insurance policy documents. Look for sections related to hormone therapy, endocrine treatments, or specialty medications. Pay attention to any exclusions or limitations. Some policies cover hormone therapy for specific conditions but not others (e.g., coverage for menopause but not for gender-affirming care).

If you find insurance jargon difficult to understand, use online portals provided by many insurance companies. These portals often offer simplified explanations of your benefits, which can help you get a clearer picture of your coverage.

Contact Your Insurance Provider Directly

After you review your policy, reach out to your insurance provider for clarification. Call the customer service number on your insurance card and ask specific questions about hormone therapy coverage. Key questions to ask include:

- Does my plan cover hormone therapy?

- What types of hormone treatments receive coverage?

- Are there any coverage limits or caps?

- What is my out-of-pocket cost for hormone therapy?

- Do I need to use specific in-network providers or pharmacies?

Take detailed notes during this conversation, including the name of the representative you spoke with and the date of the call. This information can prove valuable if you need to reference the conversation later.

Understand Pre-authorization Requirements

Many insurance companies require pre-authorization for hormone therapy. This means your healthcare provider must submit a request to the insurance company before treatment begins. The insurance company then reviews the request to determine if the treatment is medically necessary.

Ask your insurance provider about their pre-authorization process for hormone therapy. Find out what documentation they require and how long the approval process typically takes. This information will help you and your healthcare provider plan your treatment timeline more effectively.

If your insurance denies pre-authorization, you have the right to appeal the decision. Work with your healthcare provider to gather additional supporting documentation for your appeal.

Explore Alternative Payment Options

If your insurance doesn’t cover hormone therapy or if the out-of-pocket costs are too high, consider alternative payment options. Many pharmaceutical companies offer patient assistance programs that can help reduce the cost of hormone medications. Some manufacturers of estradiol products offer savings cards that can significantly lower your copay.

Another option to consider is a direct primary care (DPC) model. This approach often provides more comprehensive and personalized care, including hormone therapy, at a transparent, fixed monthly cost. This can benefit you if you require ongoing hormone treatments and want to avoid the complexities of insurance coverage.

Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) can also help if you have access to them. These accounts allow you to set aside pre-tax dollars for medical expenses, which can include hormone therapy treatments not covered by your insurance.

Final Thoughts

Insurance coverage for hormone therapy varies widely between plans. Factors such as medical necessity, plan type, and specific treatments determine coverage. You must review your policy carefully and communicate directly with your insurance provider to understand your options.

Alternative payment options exist if your insurance doesn’t cover hormone therapy or out-of-pocket costs are high. Patient assistance programs, savings cards, and Health Savings Accounts can make treatment more affordable. NuMed DPC offers comprehensive, personalized care (including hormone therapy) without traditional insurance complexities.

The question “Does insurance cover hormone therapy?” lacks a universal answer. Your specific situation, insurance policy, and healthcare needs will shape your coverage and options. Seek professional guidance to navigate these decisions and make informed choices about your hormone therapy treatment and overall health management.